Fiscal sustainability update

In 2022, the City of Sammamish identified a structural imbalance in the City of Sammamish’s financial forecast. Expenses have been outpacing revenues and the City is currently using ending fund balances (the City’s savings account) to fund ongoing services. This is neither sustainable nor a municipal best practice, and the City must make near-term changes to its budget. In 2023, the City convened a Fiscal Sustainability Taskforce, made up of community members, to review the fiscal situation and make recommendations to the City Manager.

This group unanimously affirmed the City’s structural imbalance, the community’s desire to maintain current levels of City services and provided the following fiscal recommendations:

• Reduce the City’s budget by $1 million in 2024 to lower the overall growth of City expenditures moving forward.

• Implement a 6% utility tax on all Sammamish utilities.

• Consider a voter-approved Metropolitan Parks District in the coming years.

The City exceeded the Taskforce’s reductions recommendations, identifying $2.45 million in reduction in 2024. In addition, during the creation of the 2025/2026 budget, the City kept budget increases to a minimum, increasing

this biennial budget only .7% over the previous biennial budget, even though key expenses such as personnel and services increased significantly due to inflation. Even with these reductions and limits to increases, the City is unable to maintain levels of services with existing revenues.

The discussion of the utility tax has been a part of the City’s fiscal and budget deliberations since 2023. As a part of the adoption of the 2025-2026 biennial budget, the City Council directed staff to initiate the process for the development of a utility tax. This effort is currently underway. The Council reviewed options at its 2025 retreat in early February. The public hearing related to this started Feb. 18 and will continue into March with a possible vote in late March.

For more information on upcoming Council Meetings and agendas, visit Sammamish.wa.civicweb.net/portal and navigate to upcoming meeting agendas.

The City takes its fiscal responsibility seriously, and understands the seriousness of levying additional taxes. However, we also understand the community’s desire to maintain levels of service for valued services and programs not legally nor functionally required

by a City.

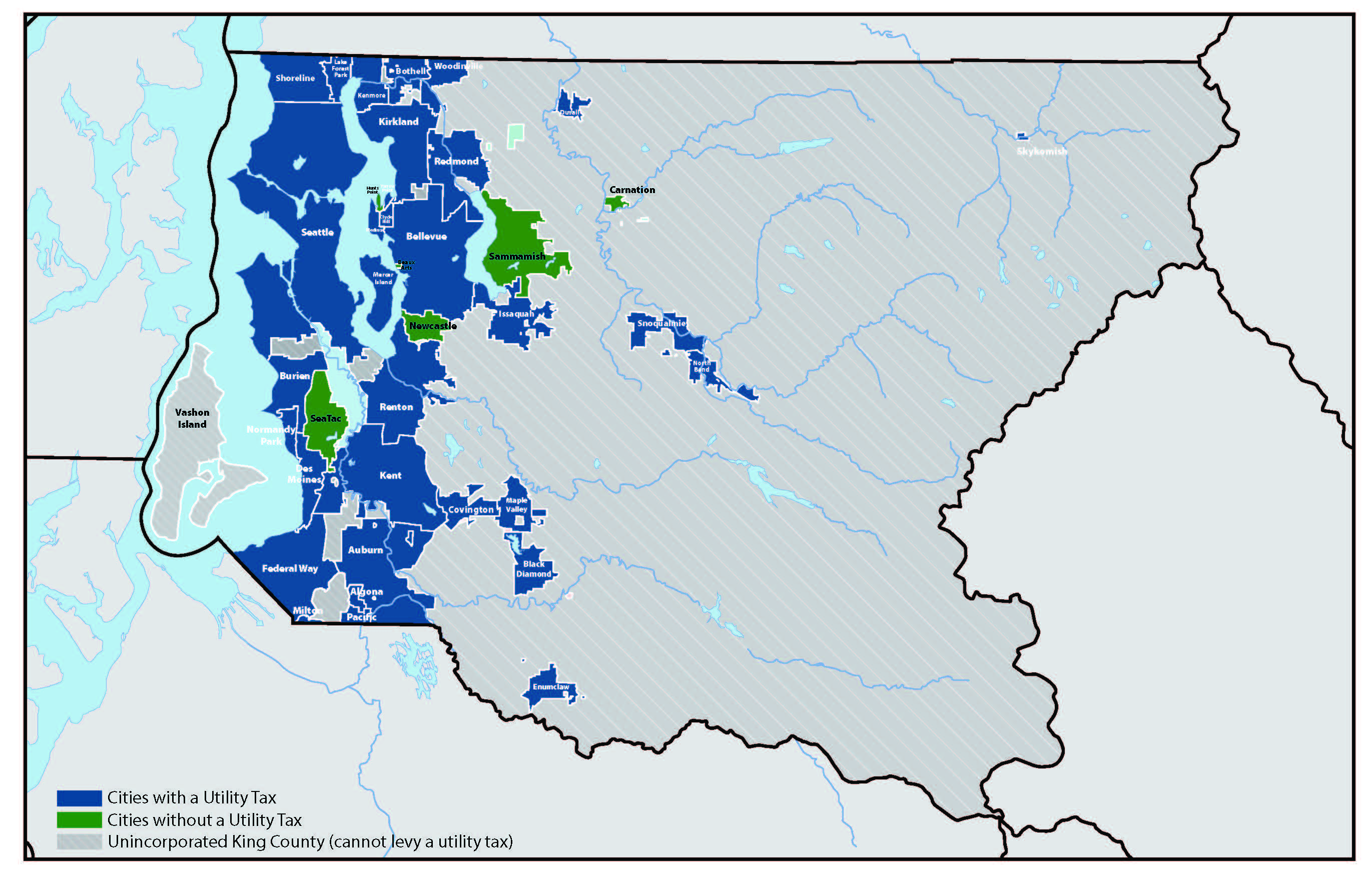

Sammamish is one of only six cities within King County that does not currently levy a utility tax. The reality of the City’s fiscal situation is that it is time now to implement a tool used by most of our neighboring cities for many years.

The City welcomes the community’s involvement in these ongoing discussions and deliberations. The public can provide comment at the next two Council meetings in March.

To look at our current budget visit: https://www.sammamish.us/government/finance/budget-documents/

To view the taskforce's findings visit: https://www.sammamish.us/news/events/events/fiscal-sustainability-taskforce/fiscal-sustainability-taskforce-august-10-2023/